The Debt Ceiling Debacle: How It’s Impacting Consumer Sentiment in the US

Table of Contents

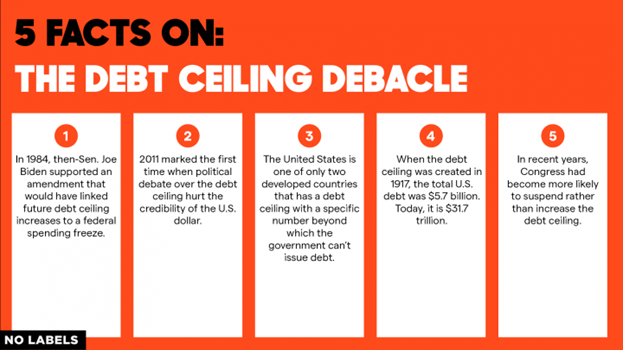

The US economy has been on a rollercoaster ride for the past few years, and the recent debt ceiling debacle has only added to the uncertainty and anxiety felt by consumers across the nation. The Consumer Sentiment Index provides valuable insight into how Americans are feeling about their financial situation in light of these turbulent times.

What is the Consumer Sentiment Index?

The Consumer Sentiment Index (CSI) is a metric used by economists and financial analysts to measure the attitudes and beliefs of consumers regarding their economic situation. CSI surveys are conducted on a monthly basis, with participants asked to rate various factors such as personal finances, job security, inflation expectations, and overall economic conditions.

The CSI is calculated using data collected from these surveys, which results in an index score ranging from 0-100. A higher score indicates that consumers have a positive outlook on the economy while a lower score suggests concerns about future economic prospects.

In addition to providing valuable insight into consumer sentiment, the CSI can also be used as an indicator for potential changes in consumer spending patterns. When consumers feel confident about their financial situation and the state of the economy, they are more likely to spend money on discretionary items like vacations or home renovations.

How Has the Debt Ceiling Crisis Affected Consumer Sentiment?

The debt ceiling crisis has undoubtedly impacted consumer sentiment in the US. This is because it creates uncertainty and instability, which are two factors that can negatively affect how consumers feel about their personal finances and the economy as a whole.

- Less confident : One of the biggest ways that this crisis has affected consumer sentiment is by causing people to feel less confident about their financial future. With so much uncertainty surrounding things like interest rates, job security, and overall economic stability, many Americans are understandably worried about what the future holds for them financially.

- Effect on interest rates : Another way that this crisis is impacting consumer sentiment is through its effect on interest rates. As we’ve seen already this year, rising interest rates can have a significant impact on everything from mortgage payments to credit card bills. This means that many Americans are likely feeling nervous about how these changes will affect their bottom line.

The Effects of the Debt Ceiling Crisis on Other Areas of the Economy

The debt ceiling crisis has far-reaching consequences beyond just consumer sentiment. For instance, the U.S. government shutdown in 2013 caused by a dispute over raising the debt limit led to billions of dollars in lost economic output and thousands of federal employees being furloughed. The uncertainty surrounding whether or not the government would default on its obligations also rattled financial markets and caused interest rates to rise.

How Can Consumers Prepare for Financial Changes Due to Rising Interest Rates?

As interest rates rise, it’s important for consumers to take proactive steps to prepare for any financial changes that may come their way. Here are some tips on how you can get ready:

- Pay down debt: If you have high-interest credit card debt or loans with variable interest rates, now is the time to pay them off as quickly as possible. This will reduce your overall debt and minimize the impact of rising interest rates.

- Build an emergency fund: It’s always a good idea to have a cushion of savings in case unexpected expenses arise. With rising interest rates, having an emergency fund becomes even more crucial, as it can help protect you from financial hardship if payments become too expensive.

- Refinance loans: Consider refinancing any loans with adjustable or variable interest rates into fixed-rate options before the rate hikes hit.

- Be mindful of new purchases: As borrowing costs increase, think carefully about taking out additional loans or making big purchases on credit that could result in higher monthly payments.

Also Read: What Are Loans Against Rolex Watches?

Conclusion

The debt ceiling debacle has had a significant impact on consumer sentiment in the US. The Consumer Sentiment Index is a crucial tool for understanding how consumers feel about their financial situation and the overall economy. As we have seen, uncertainty surrounding government policies and economic stability can lead to decreased confidence among consumers.